What is GST? A Beginner’s Guide to India’s Tax System. Get Practical GST Course by SLA Consultants India, New Delhi,

Mar 7th, 2025 at 03:28 Learning Delhi 157 views Reference: k8mepXmeMyJLocation: Delhi

Price: Contact us Negotiable

Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on the supply of goods and services in India. It was introduced on July 1, 2017, to replace multiple indirect taxes like VAT, service tax, excise duty, and others. GST aims to simplify the tax structure, promote ease of doing business, and prevent tax evasion.

What is GST? A Beginner’s Guide to India’s Tax System. Get Practical GST Course by SLA Consultants India, New Delhi,

Key Features of GST

- One Nation, One Tax – GST unifies multiple indirect taxes into a single tax system across India.

- Multi-Stage Tax – It is applied at every stage of the supply chain, from manufacturing to consumption.

- Destination-Based Tax – The tax is collected at the place where goods/services are consumed rather than where they are produced.

- Input Tax Credit (ITC) – Businesses can claim credit for taxes paid on purchases, reducing the overall tax burden.

Types of GST in India

GST is divided into four categories:

- CGST (Central Goods and Services Tax) – Collected by the Central Government on intra-state sales.

- SGST (State Goods and Services Tax) – Collected by the State Government on intra-state sales.

- IGST (Integrated Goods and Services Tax) – Collected by the Central Government on inter-state sales.

- UTGST (Union Territory Goods and Services Tax) – Applied in Union Territories like Delhi, Chandigarh, and Puducherry.

GST Compliance and Filing

Businesses registered under GST must comply with regular filing and tax payments. The major GST returns include:

- GSTR-1 (Outward supplies)

- GSTR-3B (Summary return)

- GSTR-9 (Annual return)

Non-compliance can lead to penalties and legal action.

What is GST? A Beginner’s Guide to India’s Tax System. Get Practical GST Course by SLA Consultants India, New Delhi,

Benefits of GST

- Reduces the tax burden on businesses and consumers.

- Enhances transparency and minimizes tax evasion.

- Encourages a seamless flow of goods across states.

- Simplifies tax filing through online portals.

Practical GST Course in Delhi by SLA Consultants India, New Delhi

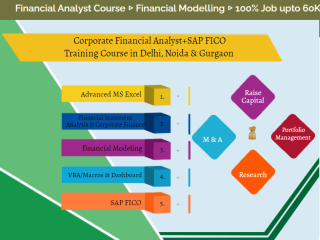

For those looking to build a career in taxation, SLA Consultants India offers a Practical GST Course in New Delhi. This course provides hands-on training in:

- GST registration and compliance

- Filing of GST returns

- GST reconciliation and ITC adjustments

- Use of software like Tally and GST portals

- Practical case studies and live projects

Who Should Join?

- Accounting & finance professionals

- Business owners & entrepreneurs

- Students pursuing commerce & taxation courses

Why Choose SLA Consultants India?

- Industry-recognized certification

- Practical, job-oriented training

- Placement assistance and real-world projects

If you want to learn GST Certification Course in Delhi in a practical way and build a successful career in taxation, enrolling in this course is a great choice!

Would you like details on fees, duration, or course enrollment?

SLA Consultants What is GST? A Beginner’s Guide to India’s Tax System. Get Practical GST Course by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

[***]

[***]

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 3 - Finalization of Balance sheet/ preparation of Financial Statement- By Chartered Accountant

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar,New Delhi,110092

Call [***]

E-Mail: [***]

Website : [***]