How to Avoid Penalties and Interest on GST Late Payments, Get Practical GST Course by SLA Consultants India, New Delhi,

Mar 11th, 2025 at 04:14 Learning Delhi 175 views Reference: gl9av9MeG1vLocation: Delhi

Price: Contact us Negotiable

Timely payment of GST is essential to avoid penalties, interest, and compliance issues. Businesses must adopt best practices to ensure timely tax payments and maintain financial discipline. Here’s how to prevent penalties and interest on GST late payments:

How to Avoid Penalties and Interest on GST Late Payments, Get Practical GST Course by SLA Consultants India, New Delhi,

1. Understand Due Dates and Compliance Requirements

-

GSTR-3B (summary return) must be filed monthly or quarterly as per the taxpayer’s turnover.

-

GSTR-1 (sales return) should be filed within the prescribed deadline to avoid ITC disruptions for recipients.

-

Payment of tax should be done before filing GSTR-3B to avoid interest charges.

2. Maintain a Compliance Calendar

-

Keep track of GST return filing deadlines to prevent last-minute rush.

-

Set up automated reminders via accounting software or compliance tools. GST Course in Delhi

-

Ensure adequate funds are available before the due date to make timely payments.

3. Use Automated GST Filing and Payment Systems

-

Utilize GST software for accurate tax calculations and timely payments.

-

Link GSTIN with banking systems for smooth and error-free transactions.

-

Avoid manual errors that can lead to miscalculations and payment delays.

4. Avoid Cash Flow Issues

-

Plan tax payments in advance and allocate sufficient funds for GST obligations.

-

Follow up with debtors to ensure timely collections and avoid liquidity issues.

-

Regularly reconcile ITC claims to optimize cash flow and reduce tax burden.

How to Avoid Penalties and Interest on GST Late Payments, Get Practical GST Course by SLA Consultants India, New Delhi,

5. Consequences of Late GST Payments

-

Late Fees: ₹50 per day (₹25 CGST + ₹25 SGST) for normal taxpayers and ₹20 per day (₹10 CGST + ₹10 SGST) for nil returns.

-

Interest Charges: 18% per annum on the outstanding tax amount.

-

Legal Actions: Persistent delays may result in GST notices, audits, and cancellation of GST registration.

6. Seek Professional Assistance

-

Consult tax professionals for GST compliance guidance.

-

Keep proper documentation of all tax payments and ITC claims.

-

File GST returns well before the due date to avoid system downtime or last-minute errors.

By implementing these measures, businesses can prevent penalties, avoid unnecessary financial losses, and ensure smooth GST compliance.

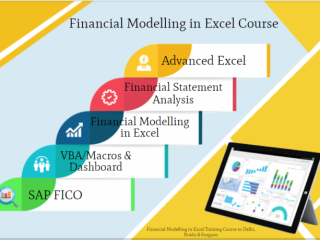

SLA Consultants India offers a practical GST course covering return filing, ITC reconciliation, and compliance strategies. Key highlights:

-

Expert-led training sessions

-

Hands-on practice with GST software

-

Real-world case studies and practical examples

-

Certification upon course completion

-

Placement assistance

This GST Certification Course in Delhi is ideal for accountants, tax professionals, and business owners seeking in-depth GST knowledge.

For more details, visit SLA Consultants India, New Delhi, or check their official website.

SLA Consultant How to Avoid Penalties and Interest on GST Late Payments, Get Practical GST Course by SLA Consultants India, New Delhi, details with New Year Offer 2025 are available at the link below:

[***]

[***]

E-Accounts, E-Taxation and (Goods and Services Tax) GST Training Courses

Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax)

Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax)

Module 3 - Finalization of Balance sheet/ preparation of Financial Statement- By Chartered Accountant

Module 4 - Banking and Finance Instruments - By Chartered Accountant

Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar,New Delhi,110092

Call [***]

E-Mail: [***]

Website : [***]